In an era where environmental conservation intersects with automobile innovation, the surge in demand for Gasoline Particulate Filters (GPFs) is undeniable. But what does this market’s landscape truly look like for B2B buyers? Is it rife with golden opportunities, or does it also pose intricate challenges?

Navigating the global GPF market can be likened to traversing an ever-evolving maze. For B2B buyers, the landscape presents myriad opportunities – from tapping into emerging markets to capitalizing on evolving emission norms. Yet, with opportunities come challenges, such as fluctuating prices, technological shifts, and stringent regulations.

For those looking to gain a foothold or expand their presence, understanding the nuances is key.

How has the GPF market evolved globally?

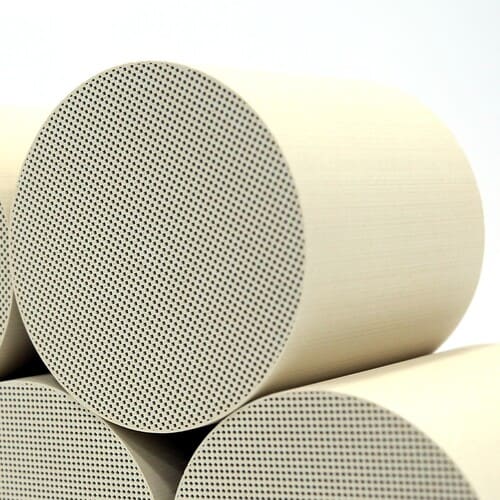

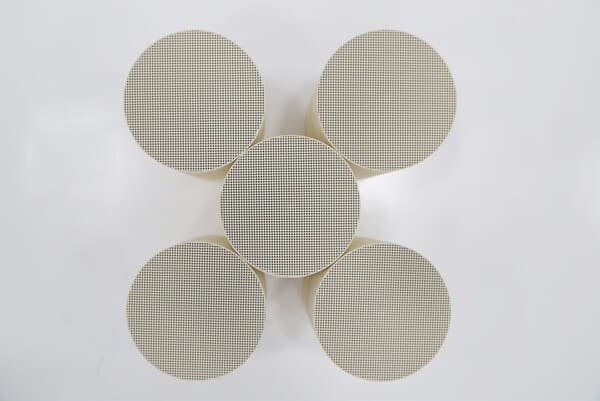

Historically, the push for GPFs began primarily in Europe, in response to the Euro 6 standards that demanded reduced particulate emissions from gasoline engines. Over the years, other regions, including Asia and North America, have recognized the necessity of GPFs, given the rise of direct-injection gasoline engines that produce more particulates.

What opportunities lie ahead for B2B buyers?

- Emerging Markets: Countries in Asia, Africa, and South America are witnessing a surge in automobile sales and are on the cusp of tightening emission norms. This presents a fresh market for GPFs.

- Technological Advancements: As research propels the efficiency and effectiveness of GPFs, B2B buyers have the chance to invest in or partner with pioneering firms.

- Regulation Shifts: As countries tighten emission standards, the demand for GPFs increases, providing a larger market for B2B interactions.

What challenges might B2B buyers encounter?

- Volatile Pricing: Prices of raw materials like palladium and rhodium, essential for GPFs, can be unpredictable, affecting cost estimations.

- Competition: With the growing demand, more players are entering the market, intensifying competition and potentially thinning profit margins.

- Diverse Regulations: Different regions have varied emission standards and timelines. B2B buyers need to customize offerings and strategies accordingly.

- R&D Investments: Continuous investment in research and development is essential to stay relevant, which can be capital-intensive.

How can B2B buyers navigate these challenges?

- Informed Decision Making: Stay abreast of global metal price trends and forecast potential fluctuations.

- Diversified Supplier Base: By not relying on a single supplier or region, buyers can mitigate risks associated with regional regulatory changes or supply chain disruptions.

- Strategic Partnerships: Collaborate with research institutions or tech startups to stay at the forefront of GPF technology without heavy R&D expenditures.

Conclusion

The global GPF market is a dynamic arena, brimming with opportunities but not without its fair share of hurdles. For the astute B2B buyer, the key lies in continuous learning, adaptability, and forging strategic alliances. As the world races towards cleaner air and greener vehicles, those who master the GPF market’s intricacies stand to not just profit, but also contribute significantly to a sustainable future.